Did you know private hospital rider could cost as much as a HDB?

The premium you pay for a private rider (from 31 to 90) ranges from $200,000 to $400,000. If you consider the opportunity cost and future price increment, it’ll be much more!

You could technically buy a 2 room HDB or a Tesla with this money!

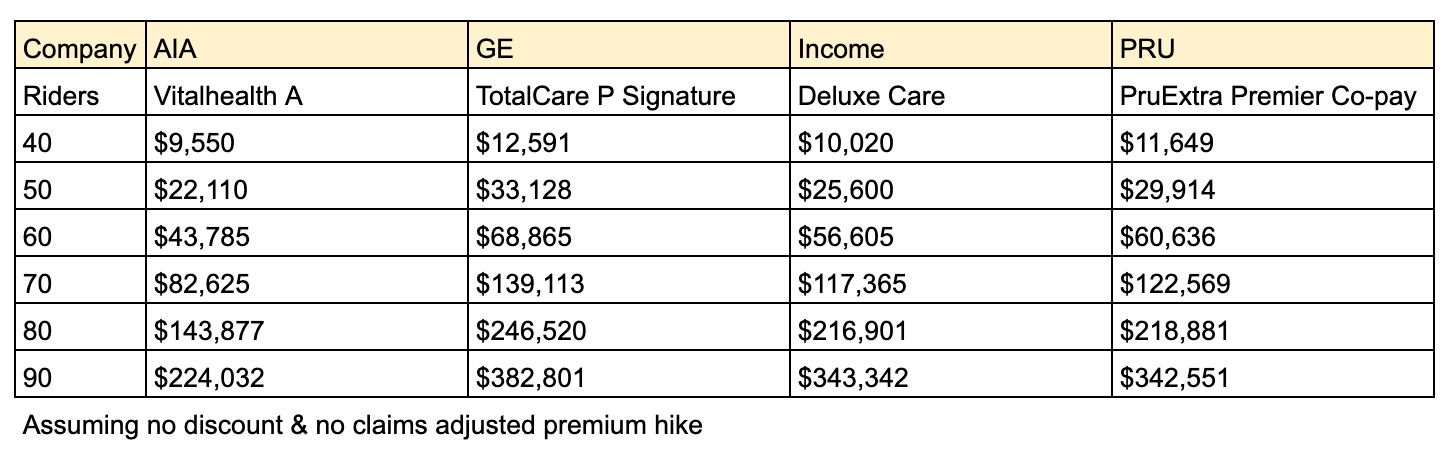

Take a look at the cumulative premiums for the riders of our 4 major IP insurers. These figures are obtained from the insurers' website as of June 2025.

Healthcare cost and medical insurance premium has been a hot topic recently.

As our health minister posited : the design of insurance product has led to “buffet syndrome”, which inflates medical expenses and insurance premium.

Going forward, rider premiums are likely to keep rising and we should give this growing expense a serious thought!

“what was once worth it, may no longer be”

With the recent withdrawal of pre-authorisation benefits by Great Eastern, I was motivated to examine this question.

Are riders still worth it?

But how do I measure “worth?”

It’s subjective.

For the purpose of this article, I'm exploring this question only from a quantitative lens.

To answer the question, we have to first understand the benefits of a rider

History of rider

Era 1 : 1994 to 2018

When rider was first introduced in 2006, it had a very simple objective. To fully cover deductible and co-insurance.

For those who want to have a complete peace of mind, pay for this add-on!

Purpose of rider: 100% Coverage

Inevitably, this disrupted the pricing mechanism of the healthcare industry. Healthcare cost escalated over the years.

To tackle the issue, Ministry of Health required all new riders from 2018 onwards to have a minimum co-payment of 5%

Era 2 : 2019 to 2022

During this period, most insurers migrated clients who are on full coverage riders into a partial coverage rider.

The purpose of rider also evolved. It no longer sought to provide 100% coverage, instead, it seek to minimise your payment.

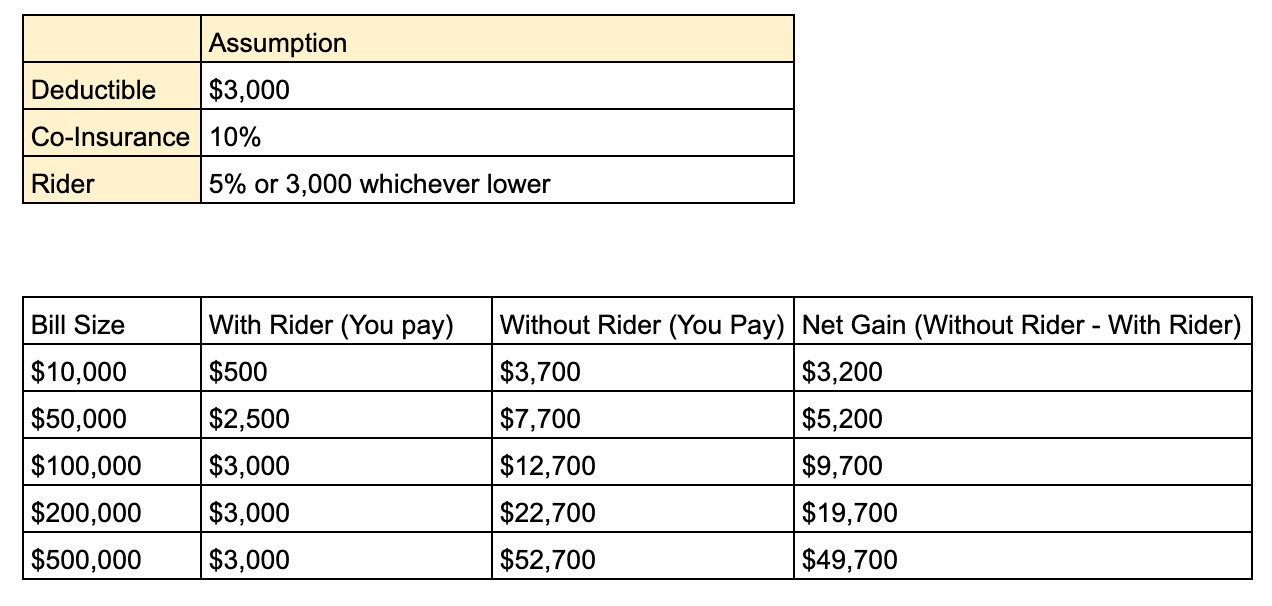

insurers did so by imposing a limit to how much you need to co-pay. Several insurers set the limit at ($3,000 or 5% of bill) , whichever is lower

Purpose of rider : provide a limit on co-payment.

Era 3 : 2023 to current

In 2022, Ministry of Health introduced Cancer Drug List.

“The Cancer Drug List (CDL) is a list of clinically proven and cost-effective treatments, introduced to keep cancer treatments affordable and enable the Ministry of Health (MOH) to negotiate better prices with drug companies.

I felt the introduction of CDL over-complicated medical insurance.

Complication 1 : Medicine which used to be covered by Integrated shield plans are no longer be covered as they fall under the non cancer drug list.

Complication 2 : The cancer drug list also stipulated a claim limit for different category of medicine. This means a drug may not be sufficiently covered.

These led to a third change in the rider landscape

Purpose of rider :

- provide a limit on co-payment.

- additional coverage for cancer drug / treatment

I hope this gives you a clearer idea of what riders are meant to cover today, or at least how I interpret their purpose.

With this, let's do the cost-benefit analysis!

The Math

We should see paying for rider as paying for 2 core benefits

- Limit on co-payment

- Additional coverage for cancer drugs / treatments

To explore point 1, Let’s take a look at different bill sizes and the impact of a rider :

How to read the table?

For a bill size of $100,000. the net gain of having a rider is $9,700.

You are better off by $9,700 in that 1 bill.

But how many times must we experience $100,000 bill to justify having this rider in our lifetime?

Assuming I am on Great Eastern's TotalCare : the cumulative premium from 31 to 90 is $382,801. This is also assuming no claims. The cumulative premium would be higher in the event of claims.

Suppose the net gain on a $100,000 bill is $9,700.

If we take Total Premium / Net Gain = $382,801 / $9,700 = 39.46

A person would have to be hospitalised for 39 times and with 100,000 bill each to breakeven the lifetime premium that they will be paying

I think the probability of this situation happening is EXTREMELY low.

Quite honestly, I don’t see how the math could justify having the rider until 90 yo.

But I thought, why not shorten the rider duration to 60yo. Just to insure us during our working years.

The cumulative premium from 31 to 60 is $68,865.

If we take Total Premium / Net Gain = $68,865 / $9,700 = 8.96

A person would still have to be hospitalised 9 times and at $100,000 bill each to breakeven!

Pause for a moment to digest this.

Do you think a rider is worth it?

To ensure this article is balanced. I also thought, what are the situations where a rider is useful?

Here are 3 which i can think of

- Extraordinary bill like $500,000

- If we are young

- For people of poor health

A friend of mine is in her 30s and have been in and out of hospital for the last 4 years. Her total bill till date is >$400,000.

In an extraordinary situation like this, the rider did its intended job. It minimised the impact to her savings, especially when she’s still in her 30s and trying to accumulate wealth. In her case, she is no longer able to buy any more insurance. Having this rider is probably the best plan she will ever have!

Finding 1 : My math suggests that having a private rider is not worth it unless we fall into the situations above!

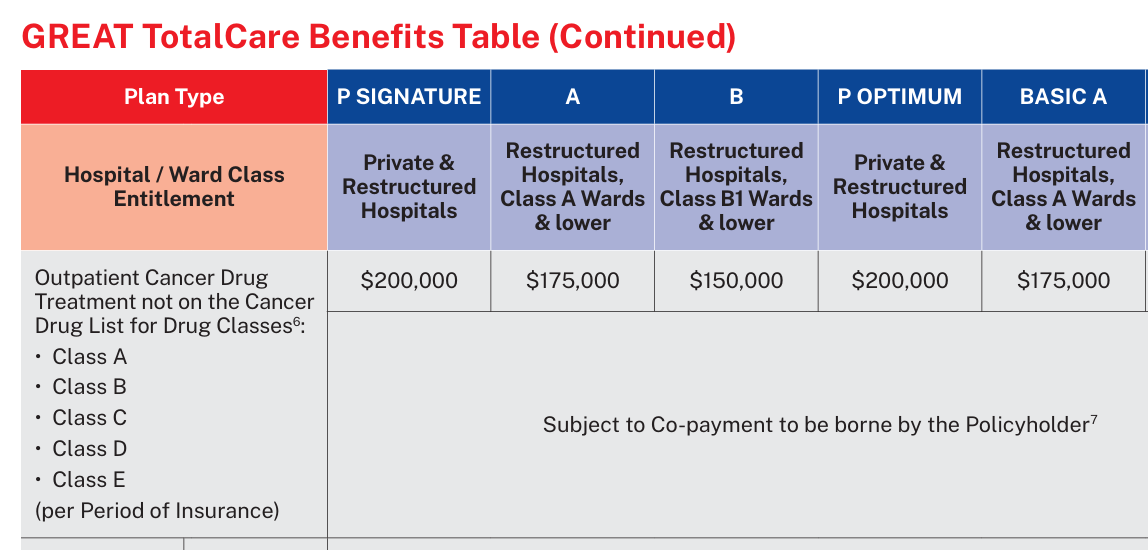

Let's move on to explore the second core benefit of rider. The coverage for outpatient cancer treatments that fall outside the Cancer Drug List (CDL).

I’ll use Great Eastern’s TotalCare rider as an example again.

The rider provides up to $200,000 of coverage per year for treatment that’s not on the cancer drug list.

Basically, the payment for rider is also paying for $200,000 of cancer drug benefit per year.

If you think about it, this may be replicated using a term critical illness plan or a cancer insurance.

If our lifetime premium is $200,000 - $400,000. i think we could possibly replicate this benefit in other form, especially if we are still young.

Finding 2 : There may be alternate path to replicate the cancer drug benefit which could be more value for money

Is a rider still worth it?

For most people, probably not past age 65. But if you’re young, uninsured or of poor health. It offers a peace of mind.

The math simply don't justify having the rider, especially in our old age.

Conclusion

I think i’ve achieved what i set out to do in this article.

To explore the question : "Are riders still worth it?"

Purely from a numbers perspective, my answer is no.

I believe there are other arguments to support having one, probably an emotional one. But I’ll leave that to other people

Disclaimer

This article is for informational and educational purposes only. It reflects my personal views and interpretations based on publicly available data at the time of writing. While I have done my best to ensure accuracy, some information may be incomplete, outdated, or contain unintentional errors. This is not financial advice and should not be treated as such. Please consult a licensed financial advisor or insurance professional before making any decisions regarding your insurance or financial planning.

Comments ()