Do You Really Earn 11% from the S&P 500?

Does investing into the index ETF monthly give you the same 11% return as lump sum investing?

Are you investing into an index ETFs?

Some of the common ones are S&P500 Index (VOO / SPY / CSPX) or MSCI World Index (VRWA / IWDA / SWRD)

Have you wondered how much do you really make by investing into them?

We've probably heard statements like : "if you’ve invested $100,000 10 years ago, it would have grown to $284,000"

Guess what, this statement is true.

If you did invest $100,000 on 1 June 2015. Your account would have $284,000 today. That's 11% p.a return for 10 years.

BUT. Only if you have invested all of the $100,000 in 2015.

What if you’ve chosen to invest it over 10 years?

Or what if you don't have $100,000 and had to invest every month for 10 years?

Will you still be getting 11% p.a?

Let's see what historical data tell us!

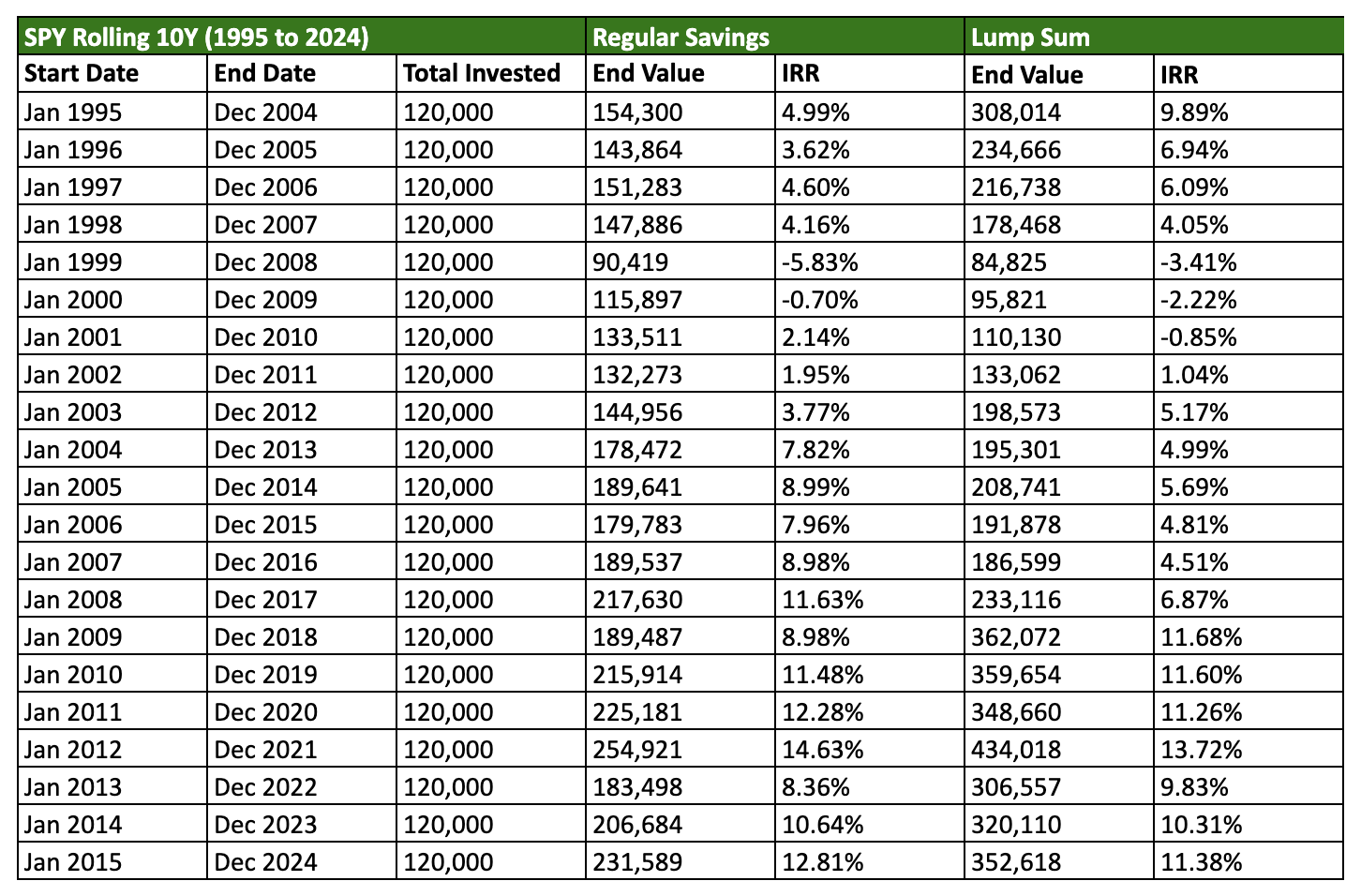

To explore this, let’s consider investing into the S&P 500 : SPY over a 10 year period. An investor will invest on the 1st day of each month. Depending on when we start, our end outcome should be different.

Regular Savings (RS) : $1,000 per month for 10 years

Lump Sum (LS) : $120,000 one time for 10 years

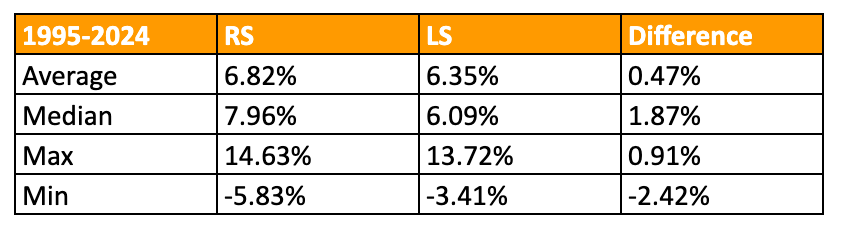

For period between 1995 to 2024. The backtested result shows the median Regular Savings return being 7.96% p.a

Which means if you have started investing within this period, there's 50% chance you'll be earning 7.96% p.a

Not bad!

In addition, RS return is slightly higher than LS!

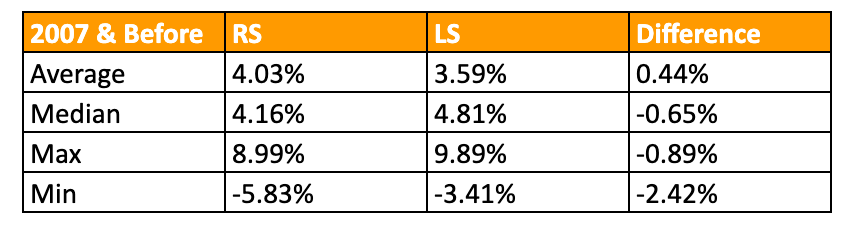

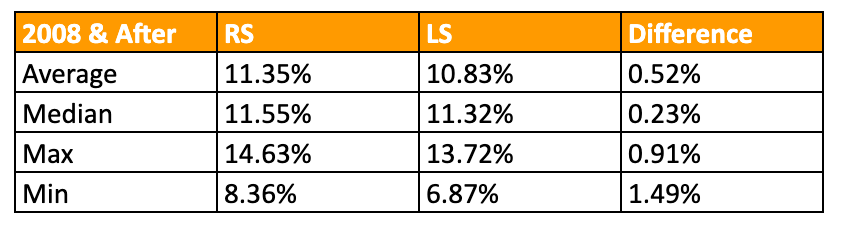

As I was looking at the output, i notice the return (post 2008) looks quite different from (2007 and before)

I believe the global financial crisis might have changed the investment landscape in someways.

Suppose your 10 year regular investment started in any year after 2008. Your median RS return will be 11.55% p.a

That is quite a big jump from 7.96% p.a

On top of that, the minimum return is 8.36% p.a. Which means, so long you've started regular investing from 2008, you will make 8.36% p.a

Conclusion

Back to my starting question. Will you be getting 11% p.a return?

Mathematically yes. In the pockets, no.

For a $120,000 investment in 2010. Your account in 2019 will be :

Regular Savings : $215,914 (11.48%)

Lump Sum : $359,654 (11.6%)

Total Invested : $120,000

Even though both returned 11%, there is a big difference in value.

This is because the money under lump sum approach has started working earlier.

Howard mark has written a memo on this in 2006! (Quite a lengthy read)

So is it fair to assume that our investment in the S&P500 will return 11% p.a?

In my opinion, probably not. Having this expectation might likely lead to disappointment

Lower expectations, Lower disappointment!

I'll leave it to you to decide 😉