Most investors focus on returns, few focus on this

“Hey Dylon, there’s a new fund and their return looks good”

It’s interesting how investors and advisors both get lured into the fads of novelty and the allure of higher return.

Every year, new funds appear and people talk about it. Some of these funds are also limited to accredited investors, offering a sense of “status” and complexity.

I do wonder, what are people’s investment philosophies and where do all these fit in.

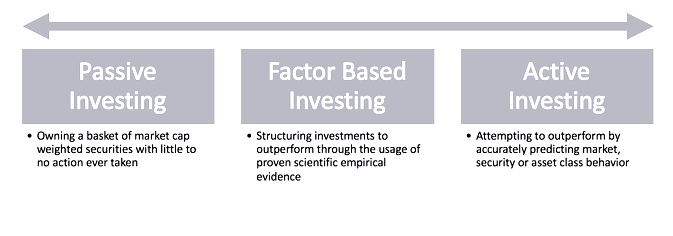

An investment philosophy lies on a spectrum, the two ends are Passive and Active.

Most investors lean active.

In portfolio management, an active approach means market timing, tactical asset allocation or security selection. By and large, evidence shows active management underperforms long term.

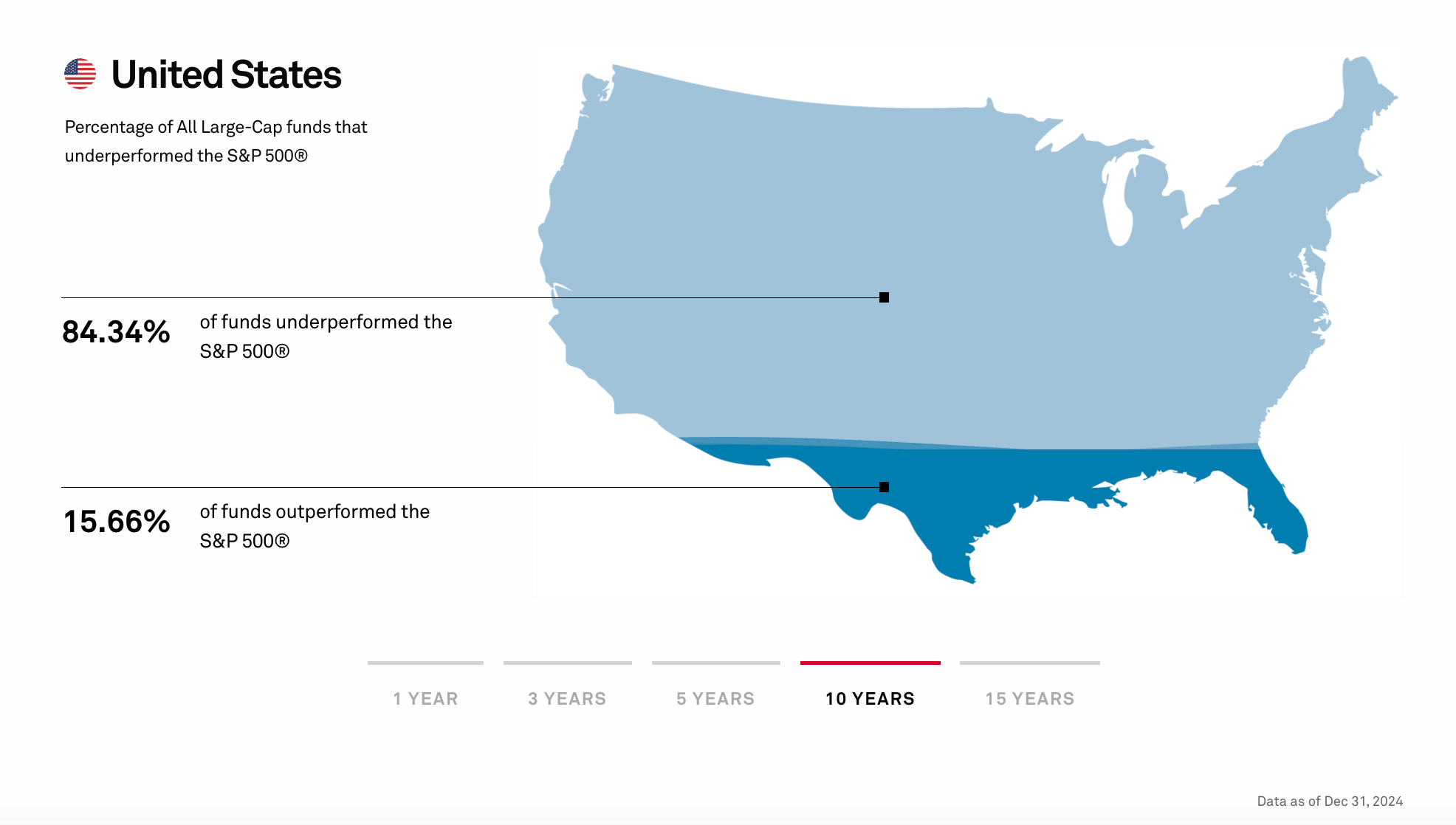

According to SPIVA, 84.34% of funds underperformed the S&P500 over the last 10 years.

What do you think happens when an investor adds more ACTIVITY into their investment journey?

Not only do returns suffer, their probability of success falls too!

Activity stems from 3 sources

- Investor

- Advisor

- Fund Manager

The fund managers are active to select the securities to invest in.

The advisors are active in selecting the fund manager and allocating the money.

The investor is active to engage the right advisor and provide the money

We can relate to this in fitness terms.

Find a trainer, the trainer provides a workout program and the gym, the gym owner provides the equipment. All that’s left is to lift!

Unlike fitness, more activity doesn’t yield better results in investing.

Every layer of activity introduces human error and fees, which jeopardises the success of an investment program

For example, some advisor ignores the need for dollar cost averaging and an investor ends up with two tiers of timing risk, on the fund manager’s level and the advisor’s level.

Completely unnecessary!

My point is, most investors focus on returns and risk, but rarely on the probability of success

Since Probability of Success + Probability of Failure = 1

An investor seeking to reduce the probability of failure will ensure a higher probability of success. Those who embrace passivity are more likely to increase their odds of success

Passivity means choosing a market, accepting the average return and insulating decisions from emotions.

One may argue, active management provides the opportunity for better returns despite lower odds of success.

Totally valid, but what’s the investor’s objective?

Are we investing so we can retire and travel the world or are we investing for the 15% return?

That’s a question every investor should think about.

“Next time someone pitches a new fund or idea, don’t ask ‘what’s the return?’ Ask instead: ‘Will this improve my odds of success?’”

Comments ()